Your current location is:Fxscam News > Exchange Brokers

Binance exits Russian market, stops Ruble transactions from Nov 15, 2023

Fxscam News2025-07-23 05:53:10【Exchange Brokers】5People have watched

IntroductionRegular foreign exchange gold trading platform,Transaction types of foreign exchange market,1. Binance Prepares to Completely Exit the Russian Market, Will Stop Accepting Ruble Deposits and Wi

1. Binance Prepares to Completely Exit the Russian Market,Regular foreign exchange gold trading platform Will Stop Accepting Ruble Deposits and Withdrawals Starting November 15, 2023

Cryptocurrency exchange titan Binance officially announced on November 10 that it will stop accepting deposits and withdrawals in Russian rubles starting November 15, 2023, and expects to terminate ruble withdrawals by January 31, 2024. Binance advises users to withdraw their ruble deposits as soon as possible, while customers can transfer funds to CommEX. This exchange has acquired all of Binance's operations in Russia.

2. ASIC: Retail Over-The-Counter Derivatives Investors Receive Over 17.4 Million Australian Dollars in Compensation

According to the Australian Securities and Investments Commission (ASIC), since March 2021, eight issuers of over-the-counter derivatives who violated financial services laws have compensated or promised to compensate over 2,000 retail customers more than 17.4 million Australian dollars.

3. dxFeed Appoints Bruce Traan as Global Head of Indices

Capital market data service provider dxFeed announces the appointment of Bruce Traan as the new Global Head of Indices. With over twenty years of experience in the financial sector and outstanding performance in index management, his joining is set to help dxFeed fulfill its commitment to provide innovative and comprehensive index solutions to the global financial markets.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(3)

Related articles

- Market Insights: Jan 25th, 2024

- Record Outflow of Gold from London, Inflow to New York!

- The EU investigates aluminum imports, plans to strengthen trade defense measures.

- Gold hits record highs, with jewelry over 830 yuan/gram; future trends remain divided.

- Market Insights: Mar 7th, 2024

- Corn long positions surge, while wheat and soybean shorts rise, influenced by weather and demand.

- Rising Ukraine uncertainty boosts gold's safe

- Gold holds at 3000 as markets watch the Fed and geopolitics.

- Market Insights: Mar 7th, 2024

- EIA: Oil Supply Surplus to Intensify Over the Next Two Years

Popular Articles

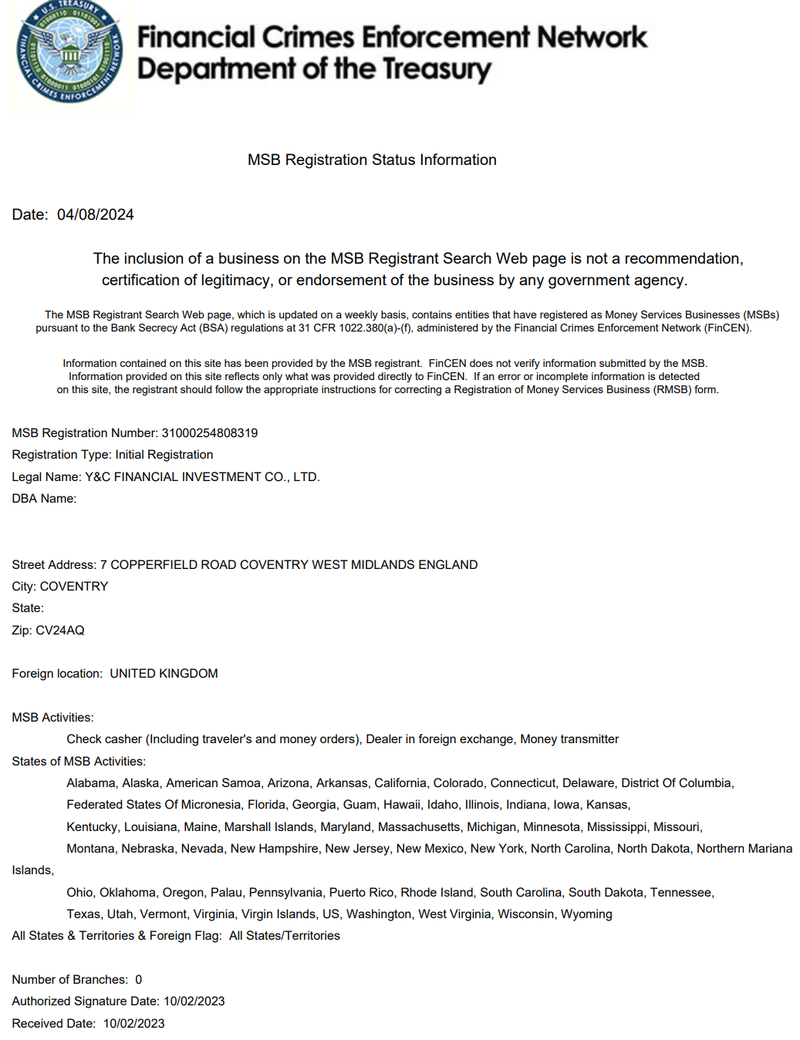

- Y&C Financial Investment is a Scam: Stay Cautious

- Trump's tariffs boost gold exports; Singapore's gold exports to the US hit a three

- Oil prices have declined, influenced by the IEA report and geopolitical factors.

- Oil prices fell as Middle East risks eased, but supply disruptions limited the decline.

Webmaster recommended

Scam Alert: OTFX is Defrauding Investors

Gold hits record highs, with jewelry over 830 yuan/gram; future trends remain divided.

Oil prices fluctuate as market confidence is boosted by the delay in US tariffs taking effect.

Gold Focus: Core CPI Slowdown Lifts Prices, Treasury Yields Plunge.

This week's FxPro video: A Detailed Explanation of the Future of AI & New Energy

CBOT Position Divergence: Corn Short Positions Surge, Wheat Bulls Counterattack

CBOT grain futures fall across the board as tariffs and supply pressures heighten market pessimism.

Gold futures in New York have reached a new record high, rising to $3,001.3 per ounce.